Need financing for your window, door, or siding project? We have a financing option available to you.

Window and Door Financing Made Easy!

Looking for an easy way to finance your window and door replacement? Look no further than Gravina's Window Center of Littleton! We offer custom financing options that can help you get the replacement windows you need without breaking the bank. Our financing program includes a $0 down payment, no prepayment penalties, and no interest if you pay on time.

Plus, our application process is easy and credit approval is fast. We also offer monthly payment options to help you manage your budget. Don't wait any longer to replace your windows and doors. Contact Gravina's Window Center today to learn more about our financing options. Our team is happy to answer any questions you may have and provide you with all the information you need to make an informed decision. With our commitment to quality and service, you can trust us to provide the best replacement windows in Colorado.

- Buy windows and doors with a $0 down payment

- There are no prepayment penalties if you want to pay off early

- No interest if paid on time

- Easy application process

- Fast credit approval

- Monthly payment options are available

Call us today to learn how easy it is to finance window replacement through Gravina's Window Center of Littleton. We're happy to answer any questions and provide all the information you need to make an informed decision. As the top replacement window provider in Colorado, we've got you covered.

Here are some other reasons why financing your windows and doors makes sense:

- No waiting. Get the entire project completed the way you want instead of waiting to save the cash.

- Flexibility. Styles, prices, and models change frequently. Avoid product and other changes by completing your entire project now instead of in stages.

- Unbeatable payment options. More ways to pay for your home improvement project. Ask your contractor about all your choices.

- Financial flexibility. If circumstances change, you may need cash reserves as a backup plan for life's necessities.

Save Your Cash

Homeowners who plan to pay for window and door projects can use funds from their savings, tax rebates, bonuses, or other sources. However, the trend is now changing as more and more homeowners are becoming aware of the benefits of financing. Financing is easier to obtain, quicker to process, and reduces financial risk. Smart homeowners are realizing that financing is the way to go.

Promotional financing options help you get what you desire without breaking the bank

Investing in upgrading the windows and doors of your home can benefit you in many ways. It can improve the look of your home, make it more energy-efficient, and increase its longevity. Upgraded windows and doors can provide long-term value as they can help reduce heat loss, thus lowering your utility bills. Additionally, they can help protect your furniture and fabrics against fading due to UV exposure. Waking up to a naturally-lit room every day can also be refreshing and energizing.

Your home improvement loan should work for you

Historically, many homeowners have paid for home improvement projects with cash or home equity lines of credit. A home equity line of credit can be called in, and the maximum loan amount can be reduced at any time. Our loans have many advantages over other funding options, including the following:

- Low, fixed interest rates. These rates are easily available to anyone with good credit.

- Unsecured. You don't have to put up your house as collateral.

- Keeps your home equity intact. Reducing home equity takes away future options.

- No headaches. After all your hard work and planning, you've earned a quick, hassle-free loan experience, and you get a response within minutes.

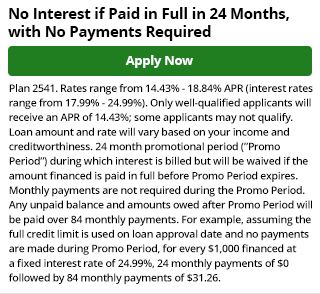

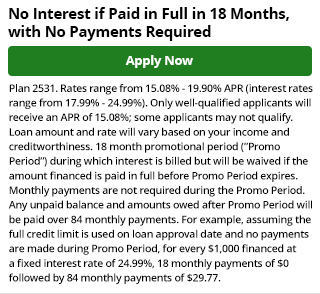

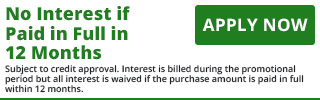

Here are Some Available Financing options available to you.

Financing Your Energy Efficient Project with a GreenSky® Loan

The GreenSky program's focus is simple. They want to help you create the home of your dreams. From deferred interest promotions to affordable budget-minded options, their loans are an easy and convenient way to pay for any home improvement project.

Supporting Promotional Disclosures

GreenSky® and GreenSky Patient Solutions® are loan program names for certain consumer credit plans extended by participating lenders to borrowers for the purchase of goods and/or services from participating merchants/providers. Participating lenders are federally insured, federal and state chartered financial institutions providing credit without regard to age, race, color, religion, national origin, gender or familial status. GreenSky® and GreenSky Patient Solutions® are registered trademarks of GreenSky, LLC. GreenSky Servicing, LLC services the loans on behalf of participating lenders. NMLS #1416362. GreenSky, LLC and GreenSky Servicing, LLC are subsidiaries of Goldman Sachs Bank USA. Loans originated by Goldman Sachs are issued by Goldman Sachs Bank USA, Salt Lake City Branch.